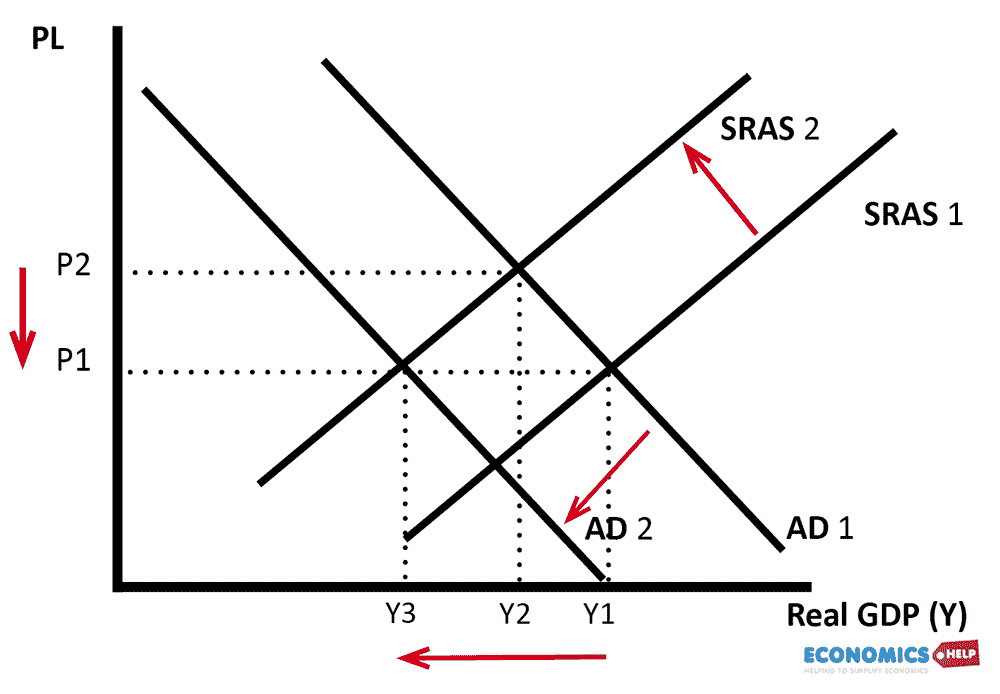

Definition: Cost-push inflation occurs when we experience rising prices due to higher costs of production and higher costs of raw materials. Cost-push inflation is determined by supply-side factors, such as higher wages and higher oil prices.

Cost-push inflation is different to demand-pull inflation which occurs when aggregate demand grows faster than aggregate supply.

Cost-push inflation can lead to lower economic growth and often causes a fall in living standards, though it often proves to be temporary.

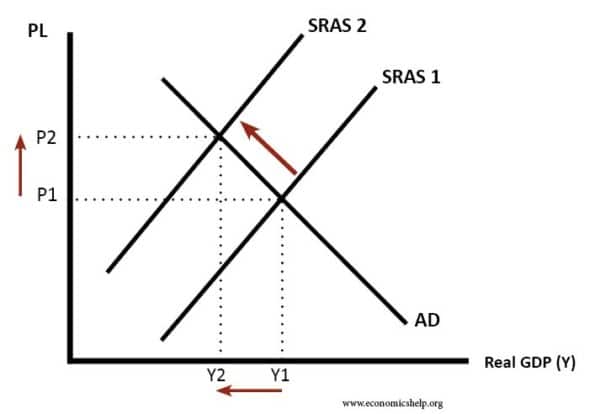

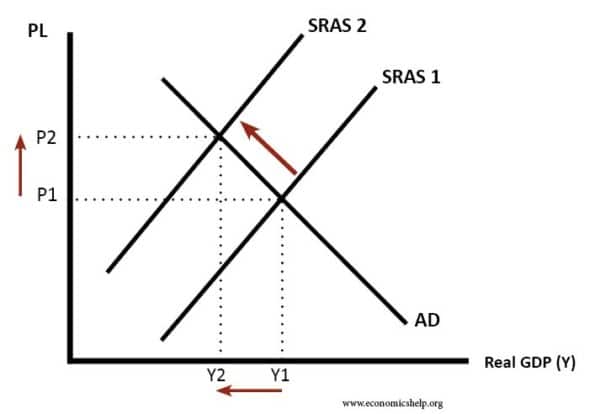

Short-run aggregate supply curve shifts to the left, causing a higher price level and lower real GDP.

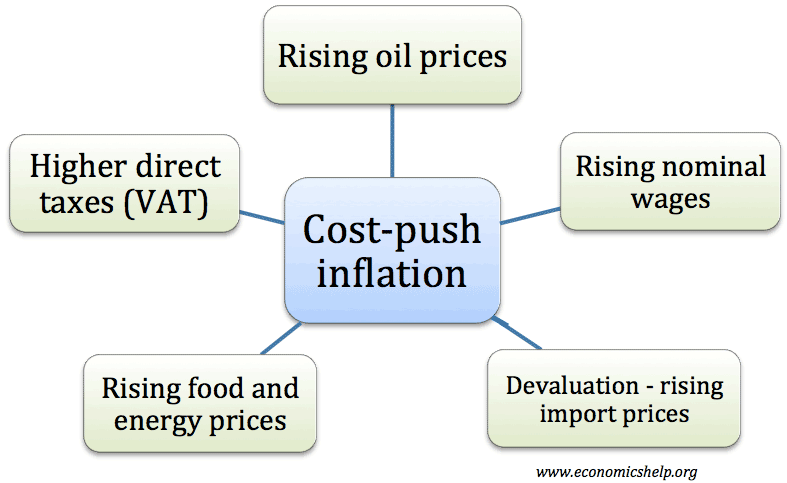

Cost-push inflation could be caused by a rise in oil prices or other raw materials. Imported inflation could occur after a depreciation in the exchange rate which increases the price of imported goods.

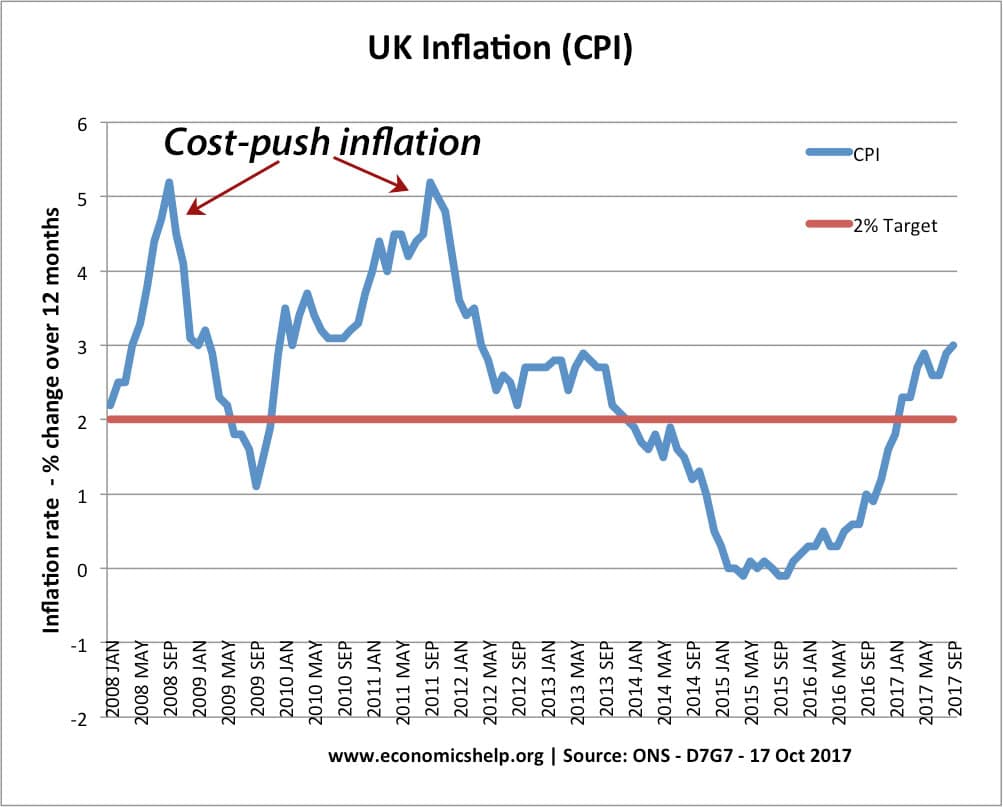

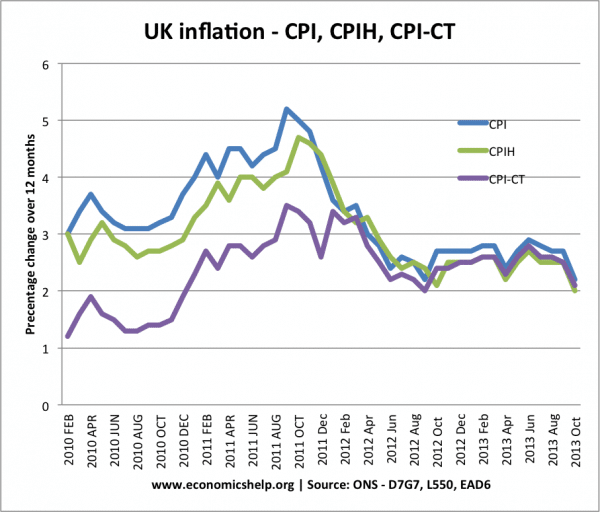

This shows two periods of cost-push inflation in the UK – 2008 and 2011. These periods of cost-push inflation proved relatively temporary because the economy was in recession.

Many cost-push factors like rising energy prices, higher taxes, and the effect of devaluation may prove temporary. Therefore, Central Banks may tolerate a higher inflation rate if it is caused by cost-push factors. For example, in 2011, CPI inflation reached 5%, but the Bank of England kept base rates at 0.5%. This showed the Bank of England felt underlying inflationary pressure were low.

Different measures of inflation indicate cost-push inflation

In 2011, CPI inflation reached 5%, however, if we exclude the effect of taxes (CPI-CT) inflation was 3%. If we also excluded the effect of higher import prices (from devaluation) inflation would have been even lower.

Other economists may fear that temporary cost push factors may influence inflation expectations. If people see higher inflation, they may bargain for higher wages and thus the temporary cost-push inflation becomes sustained.

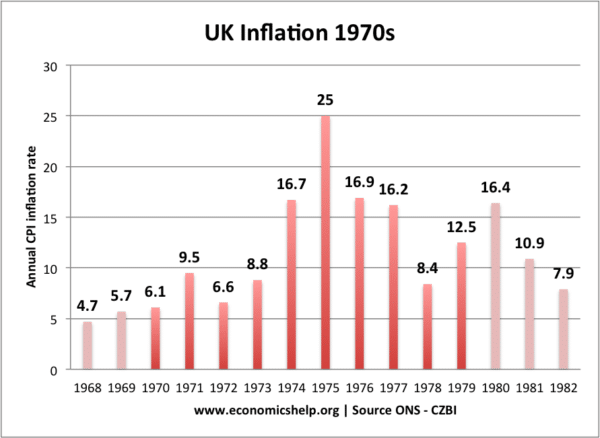

In the 1970s, there is evidence that temporary cost-push inflation fed into permanently higher inflation. This is partly because workers demanded higher wages in response to growing inflation.

Inflation of the 1970s.

In the 1970s, inflation was caused by the rapid rise in oil prices, and also rising nominal wages. Workers had greater bargaining power to demand higher wages.

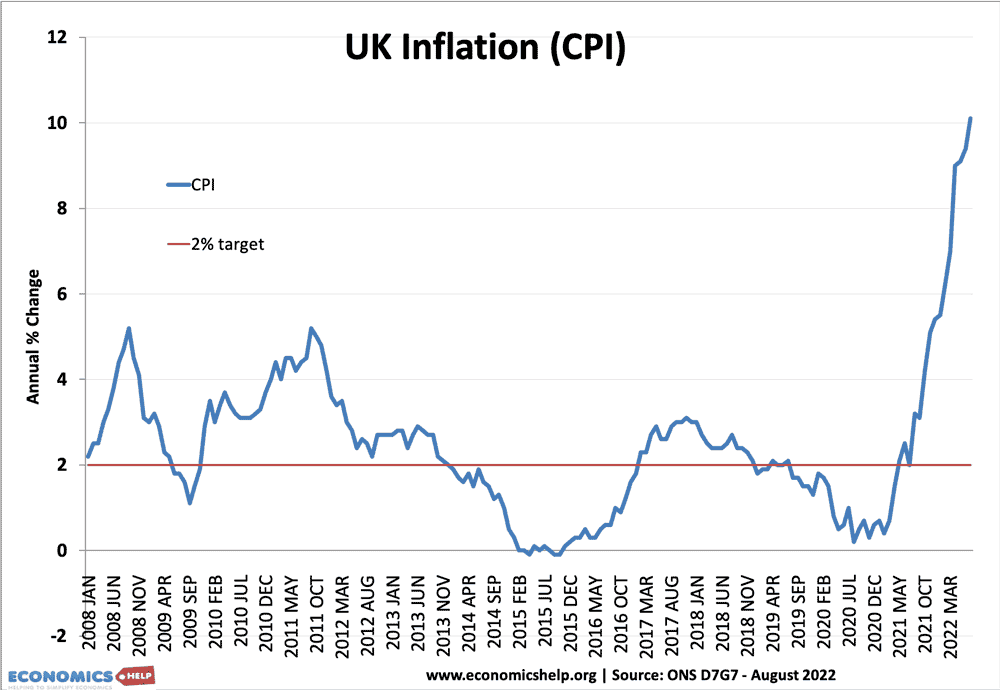

There is a spike in cost-push inflation in 2022 because

Policies to reduce cost-push inflation could include monetary, fiscal policy and also supply side policies.

The government could pursue deflationary fiscal policy (higher taxes, lower spending) or monetary authorities could increase interest rates. This would increase the cost of borrowing and reduce consumer spending and investment.

The problem with using higher interest rates is that although it will reduce inflation it could lead to a big fall in GDP.

For example, in early 2008, we had a high period of inflation (5%) due to rising oil and food prices. Central banks kept interest rates high, but this pushed the economy into recession. Arguably, interest rates should have been lower and less importance attached to reducing cost-push inflation.

The long-term solution to cost-push inflation could be better supply-side policies which help to increase productivity and shift the AS curve to the right. But, these policies would take a long time to have an effect.

Further reading